A tool to help you identify how much house you can afford AND determine which ones align with your long-term goals the best.

Key Features

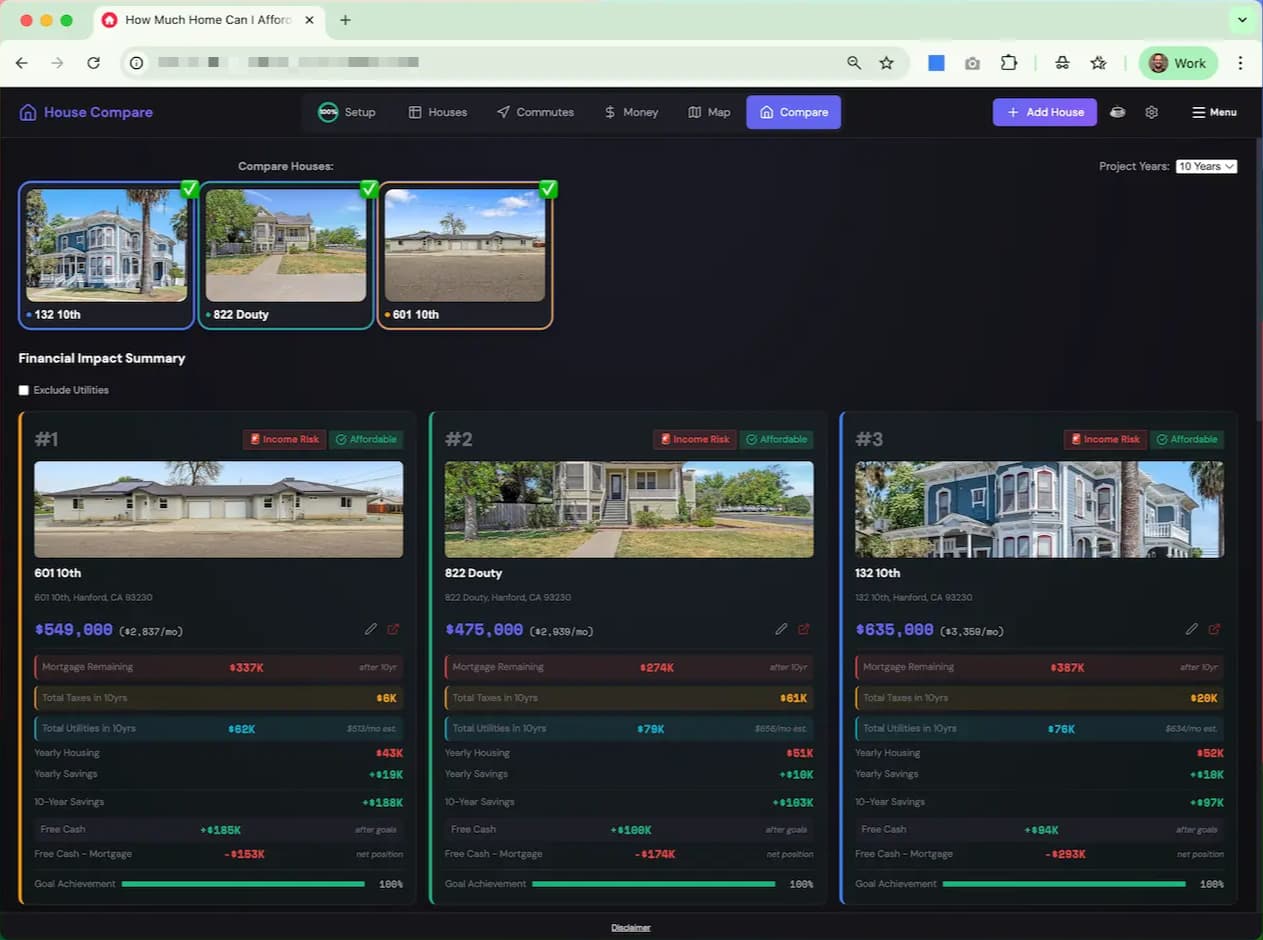

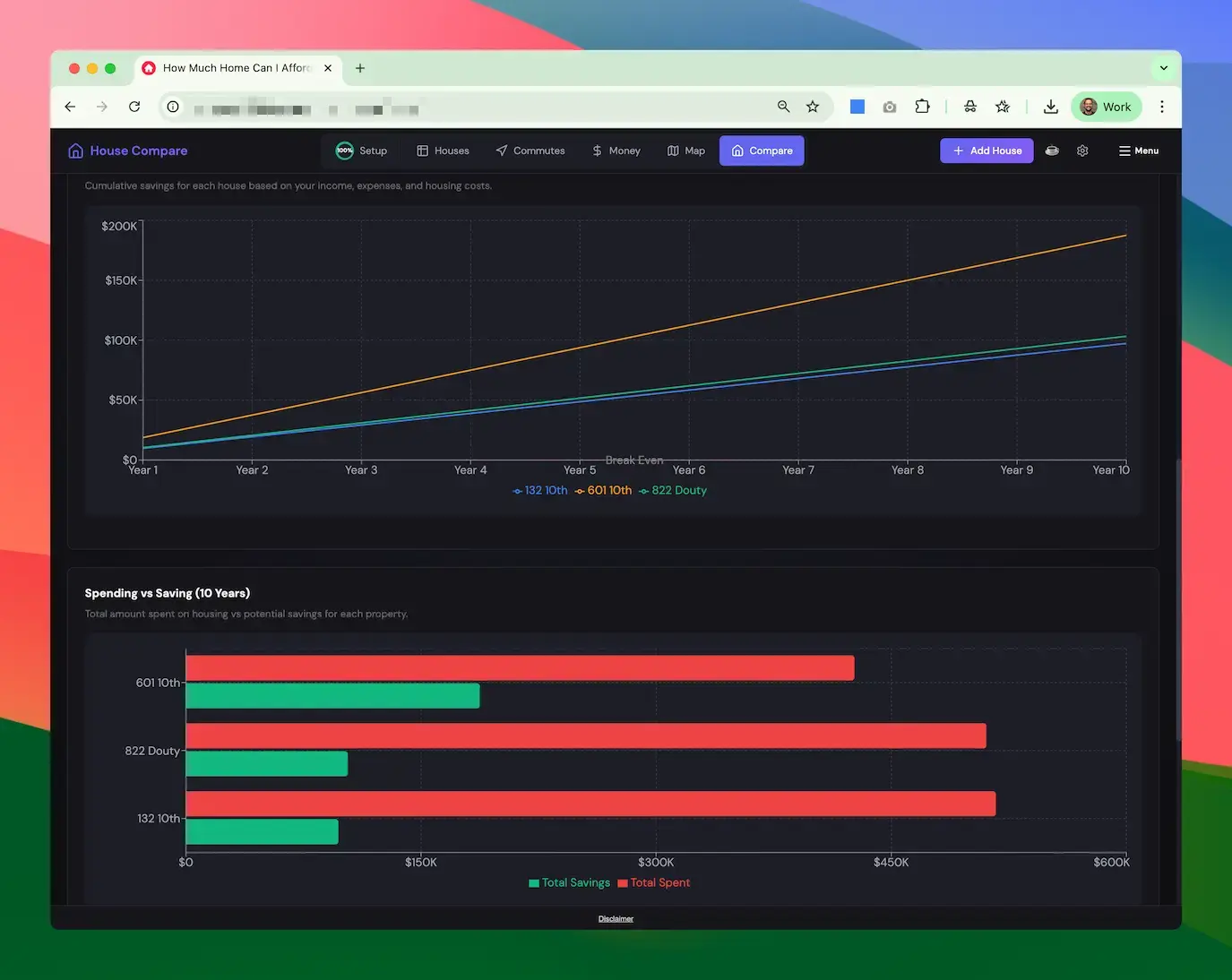

- Compare houses side-by-side with real financial projections

- Auto-import listings from Redfin

- Track commute distances to key locations

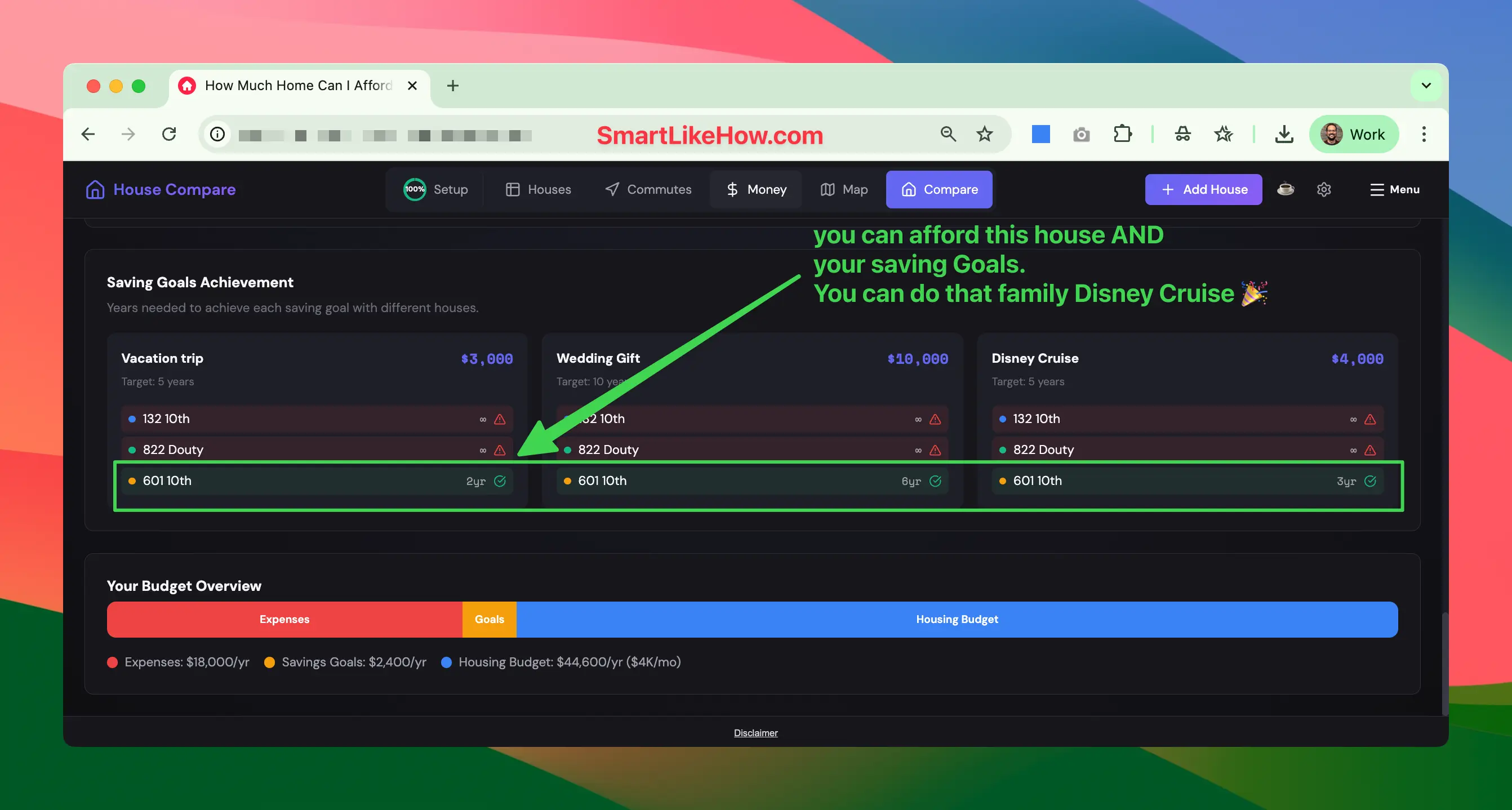

- Long-term savings and goal achievement modeling

- All data stored locally in your browser — private and secure

Look — I've been through the house-hunting grind. You find a place you love, you run the numbers, and then you spend two weeks second-guessing yourself. "Can we actually afford this?" "What about that other one?" "If we just stretch a little more..."

That's why I built this. Not another mortgage calculator. Something that actually helps you think clearly about which house fits your life — not just your loan approval letter.

The Problem with "How Much Can I Afford?"

Every house-hunting site asks the same question. And it's the wrong one.

If your goal is to hand the government $50K in property taxes over the next decade, go for it. But if you'd rather keep that money for family trips, your kid's college fund, or just not being stressed every month — then you need to compare houses differently.

Dave Ramsey gets it half right: don't overextend. Cool. But what about the other half? Once you've narrowed it down to houses you can afford, which one actually sets you up best for the next 10, 20, 30 years? That's where this tool picks up.

The Problem with "How Much House Can You Afford on $100K?"

You've Googled it. Everyone has. "How much house can I afford on $100K?" And every calculator spits back the same generic answer based on your gross income and some ratio a bank came up with.

But here's the truth: it depends. And not just on your income.

Are you planning a Disney family trip every year? Do you want to gift your kids $10K toward their wedding someday? Are you saving for a business, paying off student loans, or trying to retire before 60? Those aren't luxuries — they're your life goals. And they directly impact what you can actually afford.

The problem with every "how much house" calculator out there is that they ignore all of that. They take your salary, apply a formula, and tell you a number. No context. No goals. Just a monthly payment you're optimistically dreaming you can make right now — without thinking about what that payment costs you over the next decade.

Real affordability isn't a single number. It's a picture of your entire financial life — income, expenses, and the goals that make life worth living. That's exactly what this tool helps you see.

How do people afford houses

Well...often times, affordability comes from choosing between Family Trips or Bigger House. The better question is: How do people feel about property taxes and HOA fees over 15 years? 😅

More Than a Calculator

You know that conversation? The one where your partner says "for only $100K more we could have our dream house"? This tool gives you the actual comeback:

"Sure, but that's an extra $50K in property taxes over 10 years. I'd rather take the family to Europe. 😅"

Numbers win arguments. Or at least, they start better conversations.

How It Works

Paste a Redfin URL and the house imports automatically — price, address, beds, baths, the whole thing. Plug in your income, your expenses, and the big-picture goals you're saving toward. The tool does the rest.

You'll see, side by side, which houses leave you with the most money at the end of 5, 10, or 30 years. You can compare commute distances, rate houses on the stuff that matters to you, and actually make a decision backed by real numbers instead of gut feelings and Zillow daydreaming.

Your Data, Your Device

Everything stays in your browser. Secured by default, no accounts and no cloud storage.

Need to switch from your laptop to your phone mid-search? No problem. Generate a one-time QR code that securely transfers all your data to another device — houses, locations, finances, everything. It's a single-use link, so once it's scanned, it's gone. No accounts, no cloud storage, no data lingering anywhere.

Why Your Bank Will Approve You Anyway

Here's the thing nobody tells you: banks don't care if you thrive. They care if you pay.

When a lender runs your numbers, they're basically assuming:

- You don't go out to eat, travel, or have hobbies

- You have zero savings goals beyond not defaulting

- Nothing unexpected ever happens (ha)

We all know that's not how life works. Getting approved for a mortgage and being able to actually live comfortably with that mortgage are two very different things.

🏠 The Housing Ratios Nobody Explains Well

Financial people love throwing around percentages. Here's what they actually mean in plain English — this is just about housing costs vs. your gross income, no other debts factored in.

⚠️ And if they do explain it — you still can't see it in context. Now you can. Try the How Much House Can You Afford tool and share it. They'll be thankful.

✅ 25–30% — The Sweet Spot

This is where you want to be if you can swing it. You've got breathing room. You can invest, handle a surprise car repair, and still go on vacation without a panic attack.

- Money left over to live a generous life

- An emergency doesn't become a crisis

- You sleep better. Seriously.

Most financial advisors will tell you to aim for 28% or under. There's a reason for that — it just works.

⚠️ 30–36% — It Works, But Tight

This is where most conventional lenders will typically draw the line. You can make it work, and a lot of people do. But there's not much cushion.

- That trip to Italy might get pushed back a year... or five

- A rate adjustment or a new roof hits different at this level

- Some months you'll feel it

🚨 36–43% — Paper Math vs. Real Life

Some lenders will still say yes here, especially if your credit is solid and you don't have much other debt. But let's be real — this is the danger zone.

- Saving money? Good luck

- One bad month and you're pulling out credit cards

- The house owns you, not the other way around

This is exactly the zone where our tool throws up the "🚨 Income Risk" flag. Because the spreadsheet might say you can do it, but your actual life probably can't.

🔑 The Real Question

It's not "can I get approved?" You probably can. The real question is: "can I afford this house and still live the life I actually want?"

I built this tool to help live out your best version of you.

🙏 My prayer, that you live the most generous version of yourself.

Ready to run the numbers on your houses?

🏠 Try How Much Can I Afford for a House →